Indicators on Estate Planning Attorney You Should Know

Table of ContentsNot known Factual Statements About Estate Planning Attorney Excitement About Estate Planning AttorneyThe smart Trick of Estate Planning Attorney That Nobody is Talking AboutEstate Planning Attorney Things To Know Before You Get This

Estate planning is an action plan you can use to determine what occurs to your possessions and commitments while you're active and after you pass away. A will, on the various other hand, is a lawful document that describes exactly how properties are dispersed, that cares for kids and pet dogs, and any kind of other wishes after you pass away.

The administrator additionally has to pay off any type of tax obligations and financial debt owed by the deceased from the estate. Financial institutions usually have a restricted quantity of time from the day they were notified of the testator's death to make cases against the estate for money owed to them. Insurance claims that are turned down by the executor can be taken to court where a probate judge will certainly have the last say regarding whether or not the insurance claim stands.

The Best Guide To Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of possessions determined, and tax obligations and financial obligation settled, the executor will then look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will come due within nine months of the day of fatality.

Each individual places their possessions in the count on and names someone various other than their partner as the recipient., to support grandchildrens' education.

The Only Guide for Estate Planning Attorney

This method entails freezing the value of a property at its value on the date of transfer. As necessary, the amount of prospective resources gain at death is my website likewise iced up, permitting the estate planner to estimate their possible tax obligation upon fatality and far better plan for the settlement of income taxes.

If enough insurance earnings are readily available and the plans are properly structured, any kind of income tax on the considered personalities of properties following the death of an individual can be paid without resorting to the sale of possessions. Earnings from life insurance policy that are received by the beneficiaries upon the death of the insured are typically revenue tax-free.

There are specific papers you'll need as part of the estate planning process. Some of the most common ones consist of wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is only for high-net-worth individuals. Estate intending makes it easier for people to identify their desires prior to and after they pass away.

The Basic Principles Of Estate Planning Attorney

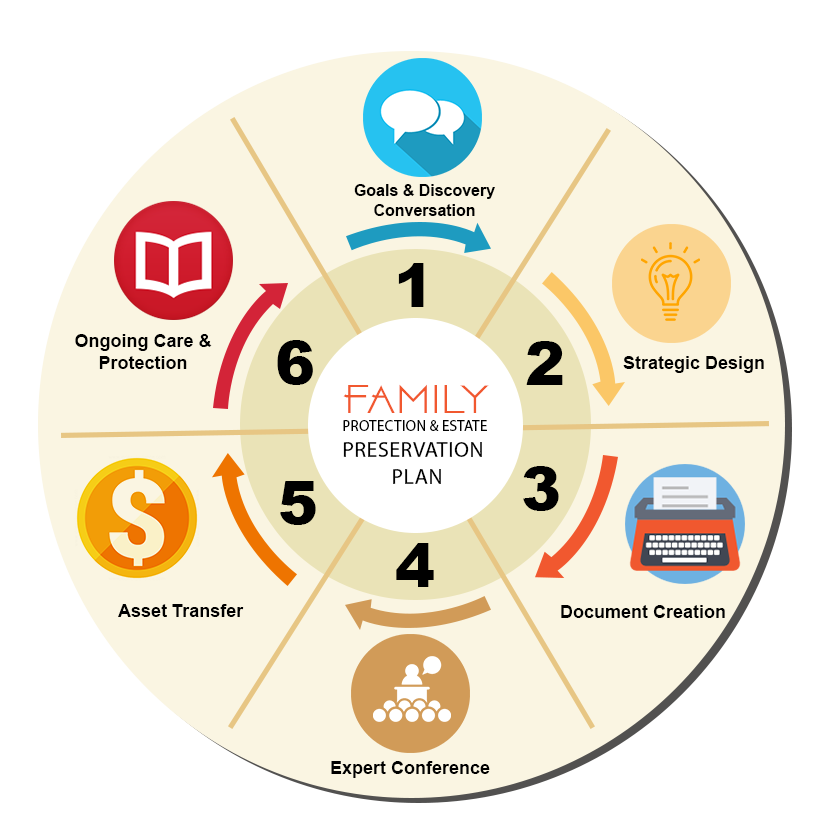

You should begin preparing pop over to this site for your estate as quickly as you have any type of quantifiable asset base. It's a recurring process: as life advances, your estate plan should move to match your circumstances, according to your brand-new goals. And maintain it. Not doing your estate planning can cause excessive monetary problems to loved ones.

Estate preparation is usually thought of as a tool for the well-off. Yet that isn't the situation. It can be useful reference a valuable way for you to handle your possessions and responsibilities prior to and after you pass away. Estate preparation is additionally a terrific method for you to outline prepare for the treatment of your small children and family pets and to detail your wishes for your funeral and favorite charities.

Applications need to be. Eligible applicants that pass the test will be formally licensed in August. If you're eligible to sit for the test from a previous application, you may file the brief application. According to the regulations, no accreditation will last for a duration much longer than five years. Learn when your recertification application schedules.